One of the most popular questions we get here at www.highincomeprotection.com is how much does disability insurance cost?

The answer: It depends.

From an information-based site such as this one, that answer doesn’t cut it. But the truth is there are so many factors that go into the pricing of a disability insurance policy that it is impossible to give an accurate answer without more information.

As a rule of thumb, disability insurance can cost from less than 1% to more than 4% of the income you’re looking to protect. The average is somewhere near 2%. There is an old example of disability pricing that has been around probably as long as long-term disability insurance itself. It goes something like this:

You're Hired! How Much Does Disability Insurance Cost?You’ve been offered two jobs. Job A pays 100k per year, but if you get too sick or injured to work, you get nothing. Job B pays 98k per year, but if you can’t do that job (due to illness or injury) then you’ll get 5k per month (60k per year) tax-free for as long as you’re out of work or until age 65, whichever comes first. Which job would you take?

The example above uses that 2% number as the cost of a long-term disability insurance policy. As mentioned, a lot goes into what your policy will cost.

A Primer – How Much Does Disability Insurance Cost?

So, less than 1% to more than 4% is a huge range of costs for your disability insurance policy. How do you know if the price you’re quoted is a good one?

If you want to know how much disability insurance costs, you first need to know how disability insurance is priced.

What influences the large range of pricing in disability insurance comes down to five key components:

- Age

- Gender

- Occupation

- Health

- Policy Design

In this post, we’ll break down each one and discuss the effect it has on the cost of your disability insurance policy. Answering “How much does disability insurance cost?” may be complex, but the more you understand the pricing, the better we can help you design the best disability insurance policy for your needs.

How Your Age Affects Your Disability Insurance Policy’s Cost

Probably, the simplest concept to understand and the most difficult to do something about, your age, has a fairly direct relationship to the cost of your disability insurance policy.

If we were at a social gathering and you asked how much does disability insurance cost, your age would be the first question asked.

You’ll note on the quote form to the left that there are very few questions we need to get started; however, your date of birth is one of them.

Simply put, the older you are, the more expensive your policy will be. And while age and price are not a strictly linear relationship, it is pretty close:

The older you are, the more likely you are to go on claim. As people age, health can cause them to miss work for an extended period of time. The average disability claim is 31-34 months, so even a relatively short disability (maybe half that time) will quickly put the insurance company in the red on your policy. They adjust for this fact by charging more for policies purchased at older ages.

The good news is that most policies will not increase in cost as you get older. A policy that has this feature is called “non-cancelable”, and the disability insurance company is not able to raise your rates as you get older.

There are three ways for the cost of your policy to increase.

- You have a rider that allows you to increase coverage (you elect it).

- Your policy does not have a non-cancelable feature and the company elects to raise rates (they can’t single you out; they would raise rates across a class or policy issue date).

- You purchased a graded premium policy.

A graded premium policy can be ideal for someone younger, not yet earning a lot of money, but wants to lock in their insurability. Graded policies will start less expensive than a comparable level cost, non-cancelable policy. It will, however, go up in price until the cost exceeds that of the level policy.

Here is a comparison of a graded policy vs. a level non-cancelable for a healthy, non-tobacco 25yo male, working in an office looking for 5k/month of coverage (meaning they make around 100k annually) payable to age 65:

As you can see, the graded premium policy starts less expensive and then becomes more expensive than the level policy.

You might think, why would I want to purchase a graded premium disability insurance policy and pay more over the life of the policy?

First, insurability. You can secure the policy today, so if your health isn’t as great when you’re making more money and truly need a disability policy, you’ll already have one.

And second, convertibility. A graded premium disability policy will offer a provision to convert your policy to a level, non-cancelable policy, so you’ll lock in your premiums going forward.

The convertible option will still be more expensive than if you bought the level benefit in the first place; however, for some people, it is an attractive option to spend a little more in the future to own the policy today.

The best way to mitigate the age issue is to purchase your policy as early as possible.

How Your Gender Affects Your Disability Policy’s Cost

Disability insurance pricing is largely affected by historical claims.

The more likely a particular demographic is to make a claim, the more expensive that group’s policies will be.

On average, women will pay 20-60% more than men for disability insurance (assuming the same age, occupation, benefits, and health). You can see this disparity here:

The next question is always, “Why?”

It comes down to carrier experience. Women make more claims than men. There are a number of reasons for this, most notably an increased susceptibility to autoimmune disorders and anxiety or depression. All those health conditions are pretty high on the list of medical reasons for disability claims, so the policies are priced accordingly. Pregnancy may play a small role but is not the reason for such a large price gap.

Not to mention, women are much more likely to go to the doctor than men, and their disability claims tend to last longer. All these factors add up to higher prices for female applicants.

There are a few things a woman can do to decrease or even eliminate most of this disparity.

Move

We know this isn’t an option for most people, but Montana is a beautiful state and currently the only state that requires gender-neutral pricing. Massachusetts is currently considering a similar requirement.

Team Up

If you work for a smaller company that doesn’t offer comprehensive benefits or a voluntary disability plan, banding together with a couple of co-workers may be an option.

A few carriers offer multi-life individual disability insurance or “common employer” coverage. Both policies stipulate that, if a certain number (3-5) of employees at the same company purchase their individual policies together, then the pricing of those policies will be gender neutral, drastically reducing the costs for the women who participate. This type of policy normally comes with a discount (10-35%), which further reduces the overall costs.

Even people who come on board afterward can be eligible for this discounted rate. So, if you’re employed by a smaller company, it might not hurt to ask around to see what other people have and if the discount is in effect.

Get Group

Larger companies normally have group long-term disability insurance available. Sometimes, it may be employer-paid (which creates taxable benefits), and other times, it may be funded by the employees (which creates tax-free benefits). Other times, it may be a combination of the two.

Group coverage is gender neutral so if you have this option available, it would be wise to consider it.

The downside is that group isn’t always portable (taking it with you if you leave), which can lead to losing your coverage. Also, group long-term disability insurance normally isn’t as easy to make a claim on and doesn’t offer limits as high as individual coverage.

Group insurance is a particularly attractive option on price alone, and having some type of income protection is preferable to having none.

Trade Associations

These may be gender-distinct or gender-neutral. Depending on your occupation, you might have an association plan available to you. Like group, these plans are normally not ideal, but pricing can sometimes outweigh the overall benefits of purchasing an individual policy.

The most important takeaway is that women may need to do more due diligence in selecting their policies than men. Pricing isn’t everything, but if you can secure similar coverage for less total cost, then why wouldn’t you?

We can help you evaluate your situation and make recommendations based on your options. Contact us today or complete the form on the left, and we’ll be in touch.

How Your Occupation Affects Your Disability Insurance Policy’s Cost

This is the characteristic most people know is required when they ask how much does disability insurance cost.

Disability insurance is based largely on your occupation. Each company has guides for their agents that are pages upon pages of job listings, duties, and how to classify them when quoting.

Some jobs, such as truckers, may sound difficult to insure, but there are several companies that will take them. Short haul (no overnights) owner-operators get decent rates.

Other professions, such as musicians, may seem easy to cover but are nearly impossible to do so (although we can).

Like age and gender, this one comes down to claims. The more likely it is for a profession to make a claim (or the easier it may be, such as in the case of the musician), the lower your occupation class.

Your Profession Dictates Your Occupation Class

Occupation classes are typically expressed as letters and numbers.

A lower occupation class is normally a B, A or 1, whereas the higher occupation classes are 4, 5, and with some companies, 6.

Medical professionals have their own classifications but follow a similar format. Where an office worker might be a 5A, a medical professional may be a 5M or 5P.

This is important because most companies that write a lot of physician disability insurance will often offer specialty specific benefits.

These seemingly arbitrary numbers and letters dictate the cost of your policy.

A 35 year old healthy, non-tobacco male rated 2A would pay 75% more for his long-term disability insurance policy than an identical individual with a 5A occupation class.

What’s more, lower occupation classes are not always eligible for the same benefits as the higher classes.

Our same 2A individual from the previous example would be eligible for a benefit length to age 67, whereas a “B” occupation class would max out at 5 years of coverage.

But Wait, There’s More!

Sometimes, people in identical professions may end up with a different occupation class. The four main culprits for these anomalies are duties, tenure, employees, and income.

Duties

You may characterize your job with a general description, but the disability insurance companies will break down what you do daily when assigning your occupation class.

Take for instance our trucker from the earlier example.

This is how a question and answer might unfold:

Trucker: How much does disability insurance cost?

High Income Protection: What do you do for a living?

Trucker: I’m a truck driver.

High Income Protection: What kind of truck do you drive? Do you stay overnight? What do you haul? Do you own the truck?

The answers to these questions (and a few others) will dictate what type of policy our trucker client can buy.

If he answers that he owns the truck, is a local driver, and delivers groceries, for example, then his occupation class will be favorable.

If he’s a long haul (overnight) trucker driving an 18 wheeler full of hazardous materials, then he’ll be much more difficult to insure (although we’d still be able to get him coverage).

In the crazy world of disability insurance, not only are no two occupations the same, but the same occupations aren’t even the same.

Tenure

How long you’ve been in your occupation can also play a role in your occupation class.

For example, an office worker in the same occupation (not necessarily the same title) for 2-3 years may have a better occupation class than someone who just started working in their chosen field.

An investment banker would be another profession that, sometimes, has limitations on how long you’ve been in your job before you’re eligible for the top classes.

Employees

This applies mainly to disability insurance for self-employed people but how many employees you have or, in some cases, supervise, can have a major impact on your occupation class.

Take, for instance, a restaurant owner. (We’re using one carrier’s guidelines for this example. Different carriers have different rules. That’s why we shop for your policy.)

A restaurant owner with 15 employees would be eligible for a 3A occupation class. There are also income and tenure milestones in the description, but for the purpose of this example, we’ll focus on the employees.

If she only had 10 employees, she would be knocked down to a 2A, paying more for identical coverage.

Finally, if she ran a small coffee shop that had less than 10 employees, our business owner would be on the same level as her cashier: “A”.

Even in some professions, where you wouldn’t think employees would matter, they do.

With some carriers, clergy can have varying occupation classes, depending on how many employees the church has. A minister who works for a church with at least 4 full-time employees (other than himself) would have a fairly high (4A) occupation class. The same company would not insure (no occupation class-no offer) a traveling minister/evangelist. Smaller congregations/roles would be classified in between.

Income

This is another classification that varies among disability insurance companies. When someone asks how much disability insurance costs, the first questions we ask are normally what you do and how much you make.

This is especially true in sales-based professions.

Realtors, stock brokers, and most sales jobs will have earnings tests to determine your occupation class.

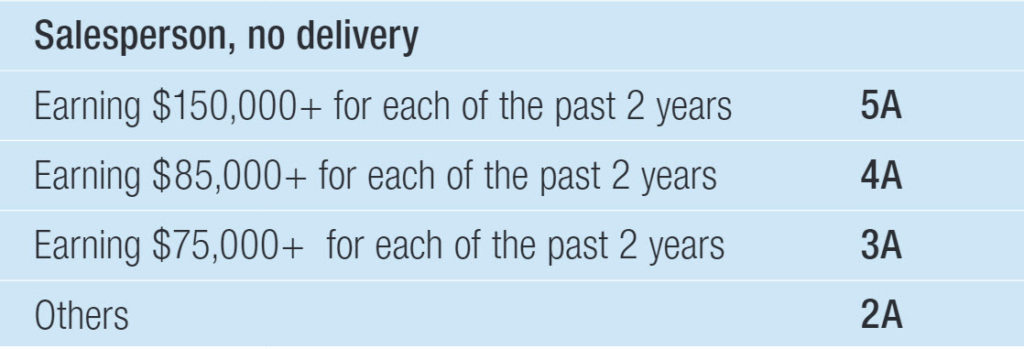

Depending on the carrier, your income may have a drastic effect on your occupation class:

As you can see, the more you make, the better your occupation class. Most professions don’t take income into account like this (for the purposes of assigning you an occupation class) but when your income is largely based in sales, they do.

As you can see, the more you make, the better your occupation class. Most professions don’t take income into account like this (for the purposes of assigning you an occupation class) but when your income is largely based in sales, they do.

How Your Health Affects Your Disability Insurance Policy’s Cost

When people ask: How much does disability insurance cost, the answer is dependent on several factors.

Your health plays a large role in your ability to buy an individual disability insurance policy. From your height and weight to major heart issues or cancer, health conditions greatly affect your disability insurance policy.

Disability insurance applications have four outcomes: approved as applied, ratings, exclusions, and declines.

Approved as applied

The simplest (and best) outcome, approved as applied, means just that. Following our K.E.E.P. process (knowledge, evaluation, eApp, placement), we quoted the best disability insurance policy that fits your needs, and your policy was approved as applied.

That means all the benefits and premium costs we discussed were accurate, and the next step is placement- putting the policy in force so your income is protected.

This is always the decision we hope for…

Ratings

A rating is an increase in the cost of your policy.

Normally applied to a health condition, a rating keeps all the benefits of your policy, but it costs more.

Ratings typically increase your costs in 25% increments. Unlike life insurance, which may have up to 16 different rating classes, disability insurance normally only has four.

These are sometimes called tables (table one would be a 25% increase over the quoted rate, table two would be 50% etc.); a rating may be acceptable depending on the rationale.

One reason to work with an independent agency is for flexibility.

Not all companies view health conditions the same.

If one company applies a rating to your policy, an independent disability insurance agency can shop that policy with another carrier to see if that rating can be reduced or eliminated.

Said another way, if carrier A was the least expensive at the time of application but applies a 25% rating (1 table) and carrier B (who was slightly more expensive in our analysis) will issue as applied based on their underwriting criteria, then we simply move your case to carrier B.

You won’t need a new paramedical exam; you’ll just need to sign a new application. It is a simple process to move from carrier A to carrier B.

Exclusions

We will normally know about these from the beginning. Exclusions are health conditions on which the carrier won’t allow a claim.

In other words, if you have a pre-existing health condition (back issues, mental/nervous disorders etc.), you won’t be able to make a claim if you’re disabled due to that issue.

Operate under the assumption that everything is an exclusion. If you have any health issue, it is likely to be excluded.

Exclusions aren’t the worst thing that can happen to you.

There are literally hundreds of health conditions that can cause a disability. If you have a pre-existing health condition that precludes coverage for that condition, you’re not going to find any policy (outside of group) that will cover it.

Therefore, taking the policy and accepting the exclusion will ensure your income is protected from all other illnesses and accidents that can cause you to miss work for several years.

Declines

The worst outcome, a decline means the insurance company will not offer you a policy.

All is not lost!

If you’re declined by our first choice, we have secondary carriers that will likely accept you. The policy will be more expensive and not have the same benefits, but having something is better than nothing.

If you’ve been declined for disability insurance due to health (or occupation), reach out to us and we’ll help you find income protection.

How Your Policy Design Affects Your Disability Insurance Policy’s Cost

- How much does disability insurance cost?

- How much do you want?

Policy design is just a fancy term for the benefits your policy will provide.

There are 4 key features of your policy that affect your rate:

- The benefit amount

- The benefit length

- The elimination period (waiting period)

- Riders

Each feature affects the cost of your policy.

The Benefit Amount

Your benefit amount is the monthly benefit you would receive if you were disabled and unable to do your job.

The most obvious of all pricing, the amount you will be paid, has a direct relationship with the cost of your policy.

The more you want, the more your policy will cost.

The Benefit Length

How long your claim can last is also impactful on your premium cost.

The benefit length or benefit period dictates how long your policy will pay a claim, should you make one.

There is a big gap between the cost of a 5-year benefit length versus a policy that covers you to age 70. The average disability claim is 31-34 months, so a minimum of 3 years is necessary.

Most of our quotes will show you a range. Anywhere from 2 years to age 65 and beyond are available.

This isn’t always the case.

If you have certain health conditions or you’re in an occupation that has a high incidence of claim, then you might be limited to a shorter benefit period/length.

This is why there is no perfect answer to the question: How much does disability insurance cost?

Your policy can be different than someone else’s for many reasons. The length of time you’re allowed to be on claim is just one of them.

The Elimination Period

Your elimination period is sometimes called the waiting period.

It is the period of time you have to wait from being disabled until you begin receiving your benefit amount.

The industry standard for long-term disability insurance is a 90-day elimination period.

Unlike benefit amounts, which have a fairly linear relationship with cost (keep all other features the same, and you can expect your premiums to increase or decrease a similar percentage-give or take 10%-with changes to the benefit amount), changing elimination periods will have a much different effect on your policy.

Going down from 90 days, for instance, will increase your premiums substantially. Even a move from 90 to 60 days can increase your premiums by over 60%.

Going the other way, however, does have a benefit, although it is not quite as extreme. Moving from a 90-day wait to a 180-day elimination period may save from 10-20% in cost, depending on your policy.

The takeaway is to optimize your elimination period. Ideally, you’d want it to be for as long as possible. After all, long-term disability insurance isn’t for fender benders; it’s for the collisions that total your (metaphorical) car.

Riders

Riders are add-ons. They change the overall benefits and costs of your policy. A disability insurance rider can do anything from making your premiums guaranteed (non-cancelable riders) to paying off your student loans (student loan riders).

Were we to discuss all the various riders available on all the different disability insurance companies’ policies, this article would double in size. There are a few that are pretty important though.

Residual Disability Riders

These riders can add 10-20% to the cost of your policy. They are important, however, because they allow you to make claims without being totally disabled.

How Much Does Disability Insurance Cost?Let’s say you get cancer (terrible but it happens). You have to go through chemo and radiation for several months. Some weeks you feel great; others you can barely get out of bed. Because of this, your earnings suffer. A residual disability rider would allow you to make a partial claim and recoup some of the money lost in this scenario.

Residual disability riders are expensive but for good reason.

Own Occupation Riders

Everyone doesn’t necessarily need (or qualify for) an own occupation rider. The less specialized your skill set, the less important this rider becomes. However, for those that don’t want to be forced into an undesirable profession, having own occupation protection is very attractive.

Unless this rider is built into your policy, it is likely an additional cost. Expect own occupation coverage to cost at least 10% more than a policy without it.

Non-Cancelable Riders

A lot of the policies that we help our clients buy are designed to be non-cancelable. If your policy is non-cancelable, it simply means the carrier can’t raise your premiums (or change anything else relative to your disability insurance policy).

Again, everyone is different, so this isn’t always the case. If you’re in your late 50s, for example, you may forgo this protection and roll the dice. After all, the company isn’t going to have too many opportunities to raise your premiums before you age out of the policy (around age 65).

Also, keep in mind that carriers can’t arbitrarily raise your rates. They must be done across the same general demographics (a certain occ class, issued in certain years, for example).

But for younger and more conservative buyers, this is valuable protection that may be worth paying more for. A non-can (industry speak for non-cancelable) rider is going to run you another 10% plus, unless it is built into your base policy.

The “Other” Riders

There are more riders out there than companies (well, maybe not, but it is close).

Everything from the aforementioned student loan coverage to catastrophic benefits if you become severely disabled (think losing limbs).

There is no perfect or best disability insurance policy.

Each one needs to be designed with the end user in mind, and what is a priority for one person may not be for another.

How Much Does Disability Insurance Cost?One of our companies offers a family benefit. If you have a spouse, parent, or child with a serious health condition (that is not pre-existing at the time of your policy’s approval) and miss work and lose income because of it, you can make a claim for up to six times your policy’s basic monthly benefit. This feature may be important to someone with a family, whereas it wouldn’t be meaningful for someone without one.

Riders, such as cost of living adjustments and future purchase options, can be really important or not important at all. Again, it all comes down to what you’re trying to protect.

Most policies are going to have riders. The ones on your policy are going to matter most to your situation. Not what others might consider “good” or “bad” riders.

Summary

So, how much does disability insurance cost? This is a long blog post for a less than definitive answer on how much disability insurance costs.

When it comes to disability insurance, there is no such thing as a general “good price”.

As mentioned, the rule of thumb is somewhere between 1% and 4% of the income you’re looking to protect. What affects this range comes down to your age, gender, occupation, health, and policy design.

Yes, some policies are more expensive than others, and yes, sometimes, people have coverage that is less than they might otherwise need.

But what is most important is having coverage in the first place.

Whether you have a small group policy that you know will pay the bills or a full-fledged individual own-occupation plan that covers almost every contingency, having something is preferable to nothing (unless you can comfortably retire right now, in which case you probably don’t need disability insurance).

We provide expert, unbiased assistance in helping consumers purchase long-term disability insurance.

If you need disability insurance and want to know how much disability insurance costs, please contact us or complete the form on your left.

If you’re getting started and want a general idea on how much disability insurance costs without inputting contact information, check out our handy disability insurance calculator.

Feel free to reach out to us once you have an idea on costs, and we’ll help you design a customized plan that fulfills all your needs.

Either way, we hope you now have a better idea on what goes into the pricing of disability insurance. We’re here to help, so please let us know if you have any questions.