Disability insurance, like life insurance, plays a crucial role in financially protecting your loved ones from unfortunate events. Whereas life insurance pays its benefits if the insured dies, disability insurance will pay benefits if you’re unable to work due to sickness or injury.

You may have disability insurance through work, or you may own a personal plan. What’s important is that you know what your policy covers and when you can make a claim. Your disability insurance policy, also known as income protection insurance, is only valuable if you can make a meaningful claim when you need it.

So, whether you’re shopping or you own disability insurance, if you want to know what’s critical with your policy, read on…

① Do You Even Need Disability Insurance?

Maybe.

Well, probably. In some form.

Unless you can comfortably retire RIGHT NOW, then you should have some form of income protection should you be unable to work for any reason.

You may have coverage through work that will suffice, or maybe you’re so frugal you could get by on the average social security disability benefit, but for most of us, purchasing an individual long-term disability policy makes sense.

I mentioned the phrase “long-term” because, if you have the basics, such as a home, credit cards, and a 6-month emergency fund, then paying the much larger premiums for short-term disability insurance rarely make sense.

The points in this article are geared towards long-term coverage.

Why?

Because what hurts people the most financially is when they miss their paycheck for one year, two years, or even longer.

② O.K., I need it. How Much Should I Have?

When it comes to how much coverage you need, it is often a personal decision.

Most companies will only cover you up to 60-65% of your net (after business deductions but before taxes) income. For those of you thinking “that isn’t enough!”, I have two things to say:

- It’s not as bad as you think. Benefits are normally tax-free if the premiums for the policy are paid with after-tax dollars (i.e., your employer isn’t footing the bill).

- You need a disability insurance policy…if you can’t afford to live on much less than what you currently make and you don’t have a few thousand bitcoin stashed somewhere, then income protection should be on your immediate to-do list.

You can purchase less coverage than the maximum. At a minimum, you should cover the basics, such as mortgage/rent, utilities, food, and other necessities.

Because many people live paycheck to paycheck, most policies we write are near the maximum allowable benefit.

③ How Long Should It Last?

Known as the benefit length, ideally, your disability policy will pay out until your retirement age, between 65 and 70 years old.

However, some people may not need or be able to afford such a long benefit period, so there are other options.

According to the council for disability awareness, the average disability claim lasts 31-34 months so usually, you should have a policy that lasts at least that long.

Besides options going to ages 65-70, many policies offer 2-year, 5-year, and 10-year benefits.

Just to clarify, all disability insurance policies will likely last well into your 60s. I’m talking about how long the company will pay A CLAIM. So, if you’re 45 years old and buy a 5-year benefit, you can still make a claim at age 53 (8 years later) and have it last up to 5 years.

④ When Will My Policy Pay?

Let’s assume you’re disabled and unable to work, so you’re eligible to make a claim.

To start collecting your benefits, you must first satisfy your policy’s elimination period.

What's an elimination period?An elimination period is similar to your deductible, but instead of paying with money, you pay with time.

The elimination period is a waiting period that must be satisfied for your policy to begin paying benefits once you go on claim.

The elimination period is a waiting period that must be satisfied for your policy to begin paying benefits once you go on claim.

Long-term disability insurance policies have elimination periods from 30 days to 360 days and longer.

The shorter your elimination period, the more expensive your policy. Most disability insurance policies we write have 90-180 day elimination periods. That range seems to have the best balance between cost and benefits.

⑤ Do You Like Flipping Burgers?

Nothing against the fast food workers reading this, but your job is very difficult.

Most people pursue a career because they’re passionate about it or they look to higher education to secure a better job.

Disability insurance policies have varying definitions on what is considered a disability.

In an ANY OCC (any occupation) policy, you’re only considered disabled if you’re unable to do ANY job for which you’re reasonably suited due to training, experience, and education.

Social security disability is considered ANY OCC. Unless you really can’t work doing anything, you will not be able to make a claim.

Alternatively, you can purchase an OWN OCC (own occupation) policy. OWN OCC policies specify that you’re considered disabled if you can’t do YOUR ACTUAL JOB. With attorneys, physicians, and a few other professions, we can even cover your specialty.

For most people, having a long-term disability policy that covers our own occupation is a must.

⑥ All Occupations Are Not Created Equal!

Similar to life insurance underwriting, disability insurance underwriting considers your age, overall health, and gender.

Similar to life insurance underwriting, disability insurance underwriting considers your age, overall health, and gender.

Unlike life insurance, disability insurance also places a heavy weight on what you do for a living.

Known as your “occupation class”, this rating assigned by the insurance company has a major effect on your premiums. Let’s look at an example.

Certified Public Accountant vs. Anesthesiologist

Both professions have advanced educations, accreditations, and likely make a very good income. But, because of professional duties, the accountant has a much better occupation class than the anesthesiologist.

If we assume they’re both 45-year-old healthy males making $300,000, we can compare pricing on an even playing field. We’ll also assume they’re purchasing a policy that will pay up to 50% of their income until age 65 with a 90 day wait (elimination) and the policies are “own-occupation”.

The numbers speak for themselves. The better your “occ class”, the lower your premiums.

⑦ All Carriers Aren’t Equal Either…

Looking at the above example, one might think that, from a disability insurance perspective, an Anesthesiologist is a terrible job. They seem to pay huge premiums for disability insurance, even though they have an advanced degree and make a substantial income.

This is why you must look to multiple companies to see who might offer you the best policy for your needs and goals. Life insurance is no different. This site, for instance, shops for your life insurance from over 40 top rated life insurance companies.

Going back to our anesthesiologist, using identical parameters, we’re able to find a policy from another company for only 963.09/mo. That’s a savings of over 18%.

Depending on this doctor’s state of residence, pricing could be below $700/mo. for this same policy.

It pays to shop for your policy with all the major disability insurance carriers.

⑧ Age Is a Factor

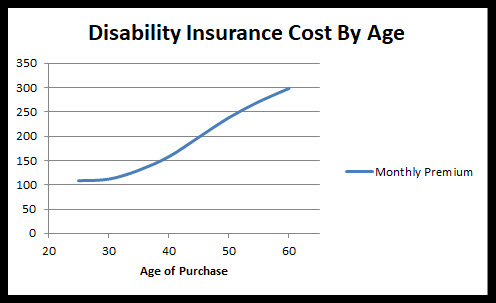

The older you are, the more you’ll pay.

That is all.

O.K. I’ll give you a little more…

As you age, disability policies become exponentially more expensive. Let’s look at an office worker making 100k annually, who purchases a policy with all the bells and whistles:

As you can see, the longer you wait, the more expensive your policy becomes. You’re also not covered in those early years, when a disability may be more unlikely but is even more financially catastrophic.

There reaches a point when disability insurance no longer makes sense. We can buy policies for people in their early 70s, but the premiums far outweigh the benefits.

The takeaway: buy your policy as young as possible. You may still consider a policy if you have at least 5 years left of work, but your options go down considerably after age 60.

⑨ Exclusions, Ratings, Declines, Oh My!

Just like life insurance, your health plays a major role in the pricing of your disability insurance policy. The healthier you are, the more your policy will cover and the less expensive it will be.

Declines

A decline is when the insurance company does not wish to offer you coverage. This can be for many reasons, such as a serious health condition, diagnostic tests that aren’t complete, or a dangerous occupation.

Ratings

A rating is an increased premium normally applied to less than ideal health, things like unfavorable height/weight ratios (build), multiple health conditions, or a history of a chronic condition such as asthma.

Exclusions

Exclusions are very common with disability insurance. Single health issues, such as mild depression, back injuries, or cataracts, may create an exclusion on your policy. That means you could not make a claim if you became disabled due to the excluded health condition.

Remember that hundreds of medical conditions may prevent you from working. Having one or two conditions excluded is not ideal; however, not purchasing a policy due to an exclusion is irresponsible.

Q. What’s the first thing you should do when one of your 100 horses escapes the stable?

A. You shut the barn door.

Taking a policy with an exclusion is doing just that. It makes sure your paycheck is protected from the other 99 conditions that can prevent you from working.

⑩ Women Pay More Than Men

We’ve seen how your occupation, age, and health play a role in the pricing of your policy. Now let’s look at gender.

Because women have longer life expectancies, they typically pay less for life insurance than men in similar health.

That anomaly is reversed with disability insurance.

Women have a much higher incidence of disability and pay much higher premiums than men.

Autoimmune diseases, mental nervous disorders, and pregnancy contribute to this. Men can have these conditions as well (maybe not the last one) but encounter them with much less frequency.

This means women pay 40-60% more for disability insurance than men.

One strategy women can use to get their pricing down is utilizing multi-life discounts or group policies to secure gender-neutral pricing.

A multi-life discount can be found when 3 or more people working for a common employer purchase a policy simultaneously.

If you’re a woman looking for disability insurance, you might team up with a few other coworkers. It will drastically reduce your premiums.

⑪ Got Group?

This is especially important for women, since group often has gender-neutral preferential pricing.

This is especially important for women, since group often has gender-neutral preferential pricing.

The policy you buy through work may be great or it may not. Understanding what you own is critical if you need to make a claim.

Group Pros

The good news: group is inexpensive, may eventually cover a pre-existing condition, and can even cover healthy pregnancies.

Group Cons

The bad news: group disability normally has caps on your benefits, is not as liberal with claims, and normally isn’t portable (you can’t take it with you when you leave).

Also, if your employer pays your premiums, then your benefits will be taxable.

If you have a group policy, review it to see if it meets your needs. It is not uncommon for people to have both a group and an individual policy to protect their income and increase their policies’ flexibility.

⑫ Business Owners Have Different Needs Than Employees

There are several types of disability insurance. Most people can get away with basic long-term disability insurance, purchased on their own or through work (or a combination of the two).

For business owners, this is not always the case. If you’re looking for disability insurance for self-employed individuals, then you must consider coverage beyond your personal income.

Business overhead expense (BOE) is a policy for your business. If you, the business owner, were to become disabled, a BOE policy will pay for things such as your rent or your payroll.

If you have a partner (or 2), then you should consider a disability buy-out plan. Disability buy-out allows a business to purchase or “buy-out” the equity of a disabled partner. Most formal succession plans have provisions for both death and disability, but the life insurance component is often the only protection purchased. Don’t skimp on the disability portion…you’re likely liable for that.

Summary

There you have it.

The top 12 things you should know about disability insurance.

Don’t worry if you’re not an expert yet. If you’re looking for disability insurance, talk to an independent agency that specializes in disability coverage.

That way, you’ll know you’re getting expert, unbiased advice in selecting the right policy for your needs.

If you’d like to learn more, you can check out our primer: Your Complete Guide to Buying Disability Insurance. In it, you’ll find several disability 101 articles, handy calculators, and the ability to request quotes.

Purchasing disability insurance may not be fun, but if done right, it only has to be done once in your lifetime. Educate yourself, evaluate your options, then purchase the best disability insurance policy for your goals.

Your family will thank you.