Petersen International Underwriters

Petersen International Underwriters

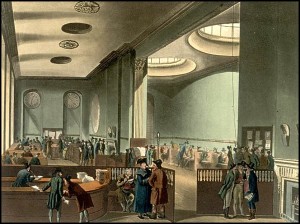

A brief history of Lloyd’s of London:

Lloyd’s of London is one of the largest insurance marketplaces in the world. They are not, as most people may think, an insurance company. It is also one of the world’s most misunderstood organizations.

More than three centuries ago, the principal form of commerce between nations was shipping. Newly discovered territories and routes around the known world opened up a whole new dimension in commerce. Yet perils in the shipping business were numerous. Pirates, uncharted or poorly charted waters, adverse weather, and other factors meant that cargo could be easily lost or destroyed in transit.

London was the main point of global travel and commerce. Many ships either began or ended their travels in London. As a result, a unique idea began to form along the docks. What if a cargo vessel worth $10,000 sank? The loss could be extraordinarily detrimental to the owner. However, what if each cargo owner participated in any loss?

Five people losing $2,000 would not be annihilation to any one person. Furthermore, the support of others sharing the same risk might allow for MORE and perhaps even RISKIER adventures to be realized.

What has changed in 300 years? Answer: Many things – and few things.

Each wealthy individual has been replaced with a single entity called a syndicate, or underwriter. Each syndicate is made up of either individual or corporate funds. A syndicate may be as large as some of the largest insurance companies in the USA. Today there are about 135 syndicates who transact business at Lloyd’s. Read more about the history of Lloyd’s of London by clicking HERE.

Petersen International Underwriters:

They are a key carrier for many of our listed plans. With excellent customer service, quick underwriting, and the ability to insure almost any risk, Petersen International is, hands down, the best underwriter for the specialized plans.

Overview

Petersen International Underwriters, Inc. is a recognized innovator and leader in the

fields of accident and health, life, and contingency insurance.

It is licensed to do business in all 50 of the United States, the District of Columbia, certain provinces of

Canada, and various countries and jurisdictions around the world.

It is also a registered insurance administrator and a coverholder at Lloyd’s, with the power of the pen and in-house binding authority.

Distribution of its products is done through professional insurance agents, brokers, and financial planners. Because of significant contributions to the art and science of professional underwriting for over 60 years, it has established a solid reputation for solving complex and hard to place risks.

In The News

For many people, disability insurance companies aren’t exactly household names. Sure, companies like Guardian and Principal might ring a bell but even some of the stronger players like The Standard and Ohio National are rarely recognized outside of the insurance industry.

Lloyd’s is one of those organizations that you realize you’ve heard of only after you hear about someone having one of their policies. Insurance policies that are written on individuals with unique skills or assets normally garner the most headlines for Lloyd’s of London. For instance, ESPN reported in 2010 that Troy Polumalu, a Pittsburgh Steelers safety, had a one million dollar policy insuring his hair. At one time, Michael Flatley of Riverdance fame had his legs insured for $47 million dollars.

At www.highincomeprotection.com, we help professionals and business owners purchase policies that guard against sickness and injury causing a loss of income. We tend to utilize the Lloyd’s of London marketplace for more traditional policies, specifically for lump sum buy/sell and for supplemental coverage for a high-income individual.

Lump sum buy/sell policies are normally capped around 2 million dollars. For a small business that is very successful and only has a few primary owners, this coverage is woefully inadequate. By utilizing a Lloyd’s of London policy procured through Petersen International, this type of business can get lump sum buyout coverage for well over 5 million dollars, ensuring that a sickness or injury to one of the principal owners doesn’t derail their profitability or growth.

Because many individual disability insurance policies won’t cover more than 20k per month, those earning north of $370,000 often need to look to a supplemental carrier for necessary, additional disability insurance. Lloyd’s of London has policies that can stretch up to 100k per month if necessary, offering even the upper-income professional or business owner plenty of disability insurance protection.

For those that need this type of policy, Lloyd’s is a critical player in the disability insurance space. As an agent for Petersen International, a coverholder for Lloyd’s, we are able to assist anyone needing a specialized policy for his or her needs. Please contact us today at 888-636-2310 or simply fill out the quote form on the left and we will be in touch.

Information about Petersen international and Lloyd’s of London was reprinted by permission by PIU.org