Mutual of Omaha has one of the most diverse disability portfolios on the market. Although their primary focus is the blue-collar market, they have a variety of products suitable for almost any occupation. They have a long history of paying claims and is probably one of the most recognizable names in the industry. However, one should never purchase a product on name alone. Each situation is unique. If you’d like to receive customized quotes for disability insurance, please complete the quote form on the left or simply contact us.

Who is Mutual of Omaha?

Mutual of Omaha was chartered in 1909, making them well over 100 years old. The company has several subsidiaries, included United of Omaha, Companion Life (serving NY state), United World Life.

Having a rich history of strength and stability is an important feature that the company that you choose to buy your disability insurance. Mutual of Omaha fits this requirement nicely.

Like many insurance carriers, Mutual of Omaha offers many products. Medicare supplements, life insurance, and annuities are just a few of the insurance products they have on their shelf. Since this site focuses on individual disability insurance, we’ll profile the company on their income protection products only.

Mutual of Omaha Financials

Having a diverse group of financial and insurance products allows Mutual of Omaha to be a very stable and secure carrier.

As of the time of this review (2019), as a company, they had a 3.2 billion dollar policyholder surplus, which represents added security for the owners of their policies.

Mutual of Omaha is a mutual company, so they are owned and operated by the policyholders. Being a mutual company allows them to concentrate on long-term growth and the needs of their customers as opposed to the short-term fluctuations of the equity markets.

Mutual of Omaha has an A+ rating from A.M. Best which is considered superior and is the second highest rating out of 16. Ratings are important because they evaluate the financial stability and claims-paying ability of the insurance company. Here, Mutual of Omaha grades out very highly.

Products Offered

Mutual of Omaha has one of the most diverse product offerings on the market today.

They market annuities, life insurance, final expense, Medicare supplements, long term care, and of course, disability insurance.

Even in the disability insurance space, their offerings are wide-ranging.

Unique Disability Offerings

They are one of the only carriers in the market that offers individual short-term disability insurance. Short-term disability insurance normally has a shorter elimination period (like 0-14 days) and coverage of fewer than two years. It is also very expensive since it is so easy to go on claim. Frankly, if you have an option to get short term DI through a group, it is really something to consider due to cost alone.

They are also one of the few carriers that offer accident disability insurance policy. Essentially, accident-only disability coverage will only pay out if you cannot work due to some injury. It doesn’t cover illness/sickness. Since 90% of claims are for illness/sickness, this is unlikely the only coverage that you’d want to have. However, for those that are uninsurable due to health or are younger and in a more physically demanding profession, it can be valuable coverage.

Mutual of Omaha Individual Disability Policies

So while the short-term and accident disability options may not be traditional policies, Mutual of Omaha does offer three “core” options.

The first two can be found in their DI Choice portfolio.

Technically, their accident and short-term policies are part of this portfolio, but the more mainstream products are their long-term disability insurance and the business overhead expense (BOE) protection.

Long-term disability insurance is one of the most important types of coverage that one can have.

It offers income protection if you’re unable to work due to illness or injury. There are normally two things that differentiate short-term disability insurance from long-term disability insurance: The elimination period and the benefit length.

Short-term disability insurance normally has a much smaller elimination period (or waiting period) than long-term. That means you can make a claim much earlier with most short-term disability policies. Some short-term disability insurance has waiting periods as short as 0-7 days.

Contrast this with long-term disability insurance where the shortest waiting period is 30 days and the normal or typical waiting period is 90 days.

The benefit length or period is also relatively small in short-term disability insurance policies. These policies typically pay benefits for 3 to 24 months. Long-term disability coverage has a minimum of 24 months, but the coverage is normally designed to last much longer, sometimes to age 67 or even age 70.

Business overhead expense (BOE) is a policy for business owners that are there to protect the financials of the business and keep it operational should the owner cannot work.

Essentially, these policies will pay for business expenses such as rent/lease, payroll, utilities, etc., allowing the business to continue operations while the owner recovers.

These policies normally pay claims for 1-2 years, giving the business owner time to sell the business if the disability will be long-term/permanent or find a suitable replacement.

Both of these Mutual of Omaha disability insurance policies are traditional policies. Almost every insurance carrier in the market that offers disability insurance has both of these policies available.

The third “core” option is their Priority Income Protection plan or PIP.

This policy is unique to Mutual of Omaha and can be attractive for those with difficult to ensure professions or those who just want simplified coverage and a much quicker underwriting process.

PIP from Mutual of Omaha is what’s known as a non-occ disability insurance policy. To put simply, it doesn’t cover any injuries/sicknesses incurred while at work. It only covers accidents/illnesses that can be determined to have not been caused by one’s occupation.

This policy offers streamlined underwriting and can cover any profession (since you can’t go on a claim for a workplace accident/illness).

Its maximum benefit amount is 4k/month, and benefit length options are 12, 24, or 36 months. The elimination period is set at 30 days for accidents and 90 days for illness.

Where Do They Fit?

Mutual of Omaha disability insurance covers a wide variety of niches. While there are is no perfect disability insurance policy, certain policies can be a great fit for certain circumstances.

Blue Collar Workers

Mutual of Omaha can be great for blue collar workers. Their BOE plan is liberal with occupation classification and their primary long-term disability insurance policy offers a 15% discount for self-employed disability insurance applicants.

Whether you’re self-employed and can benefit from these two products/features or not, Mutual of Omaha is one of the best disability insurance carriers for blue collar workers.

Simple Disability Insurance Coverage

Mutual of Omaha makes it very easy for you to buy disability insurance.

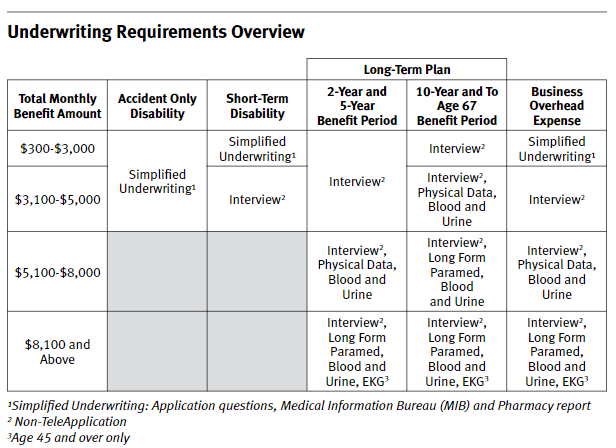

Depending on your age, most of their plans don’t require any examinations if you stay under a certain benefit amount. That benefit amount is 3k and decreases as you get older. Below is their chart for their choice series of products that outlines their no exam disability insurance qualifications.

Their PIP (Priority Income Protection) plan takes things a step further. Not only do they not require an exam, but the process is 100% online, is very forgiving regarding occupations, and has a very fast decision process.

Their traditional coverage is excellent for blue-collar workers and self-employed individuals where their PIP plan is great for people looking for mortgage protection or have difficult to ensure occupations.

Either way, Mutual of Omaha policies offer something for just about everyone, especially if you’re looking for simplicity.

Mutual of Omaha Pros

Being A+ rated, having a diverse portfolio of products, and fair underwriting makes Mutual of Omaha one of the larger players in the disability insurance space.

If you’re blue-collar, self-employed, or just want some really simple coverage to protect your mortgage, then Mutual of Omaha products are great options for you.

Mutual of Omaha Cons

There’s not a lot of negative things to say about this company.

Their traditional plans still don’t have an eApp so the application process can take longer than it should.

Having a plan that does well for blue-collar workers is great, but if you’re a white-collar professional, then Mutual of Omaha may not be the carrier for you.

Last, none of their plans are non-cancelable, meaning that their rates are not guaranteed. Although rate increases are extremely rare, not having your policy’s pricing guaranteed can be an issue for some insureds.

Summary

Mutual of Omaha is a fantastic carrier that offers a lot of different options if you’re looking for disability insurance coverage.

For those that are self-employed or just want a simple policy to cover accidents, Mutual of Omaha has a lot of great options.

It will be hard to determine whether or not Mutual of Omaha is the best disability insurance carrier for you.

Disability insurance is a complex product.

However, having someone like our agency to guide you through the process can be helpful. If you’re interested in a Mutual of Omaha quote or any other carrier (we’re independent and can quote the best disability insurance companies), simply complete the quote form on the left or contact us.

We’re here to help.