Disability Insurance Statistics

In general, disability insurance statistics can be frustrating to interpret. In fact, so are most of the insurance industry statistics that are presented to the public. It is simply too easy for the information to be manipulated by companies and the supporters of the study to work backwards to purposely support their cause.

My industry (insurance) is known for this. The long-term care industry reports significant numbers about how many people will need and qualify for care before passing away:

According to the U.S. Department of Health and Human Services, “At least 70 percent of people over age 65 will require some long-term care services at some point in their lives.” (National Clearinghouse for LTC Information)

That might be true; however, does that mean 70% of individuals need long-term care insurance? This is how the statistic is normally implied, yet many people need not purchase long-term care since they’re likely to end up on Medicaid anyway.

It also doesn’t consider many people who “qualify” for long-term care services but never need it due to passing away quickly.

Does that mean people don’t need long-term care insurance?

Absolutely not. Long-term care insurance is critically important for those looking to protect assets and provide peace-of-mind to themselves and their families. Sites like Long Term Care Insurance Partners focus on providing independent, experienced, objective advice in helping mid to high-net-worth individuals secure long-term care insurance.

However, that doesn’t mean all the statistics must be trusted.

Disability Insurance Awareness Month

For those of you that don’t know, May is Disability Insurance Awareness Month.

As an industry, our goal is to help people, especially those not covered through work or with earnings that make a group policy far too small, consider purchasing an individual disability insurance policy.

This isn’t charity; we sell these policies. However, we cater to a relatively small subset of the general population of the United States.

So, I always look at disability insurance statistics and infographics with a healthy dose of skepticism. Specifically, is the data that I’m reviewing another case of an insurance industry sector pushing products on people who either don’t need them or who already have existing coverage or are they legitimate disability insurance statistics, highlighting a major disconnect for consumers?

The Breakdown

Purchasing a disability insurance policy is a decision that shouldn’t be taken lightly. There is a lot of great information and disability insurance statistics in this infographic, but it is important to separate what is vitally important for a consumer to understand what might be information that is less critical to this decision.

Let’s look at the feature infographic point by point:

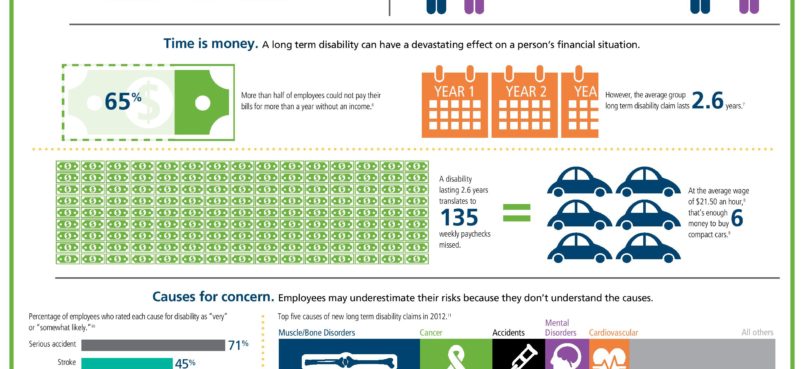

Short of Guidance

I am not surprised most employers and employees don’t understand what they offer or what they have. Often, employees think they’re covered for everything when they are covered for little.

The two examples that jump to mind are total disability/residual disability and salary vs. commissions.

The AMA disability insurance policy is a great illustration of the first example. Many physicians erroneously believe they are covered should they be only partially unable to perform their duties under an AMA group policy.

That is not true. The AMA disability insurance policy specifically states a physician must be totally disabled before collecting partial or residual disability benefits.

Do you have cancer and can only work one or two weeks per month? Too bad, you’re not totally disabled, and although you suffer diminished earnings due to your condition, you can’t go on claim. Had this physician purchased individual disability insurance, they could go on claim and make up much of their lost earnings.

The second example is straightforward. Many group policies don’t cover commissions or bonus, only salary.

So, if you’re in a profession where a large percentage of your income comes from one of these two sources, then you’re out of luck if your current policy doesn’t cover these forms of income.

Purchase an individual disability insurance policy to mitigate this risk.

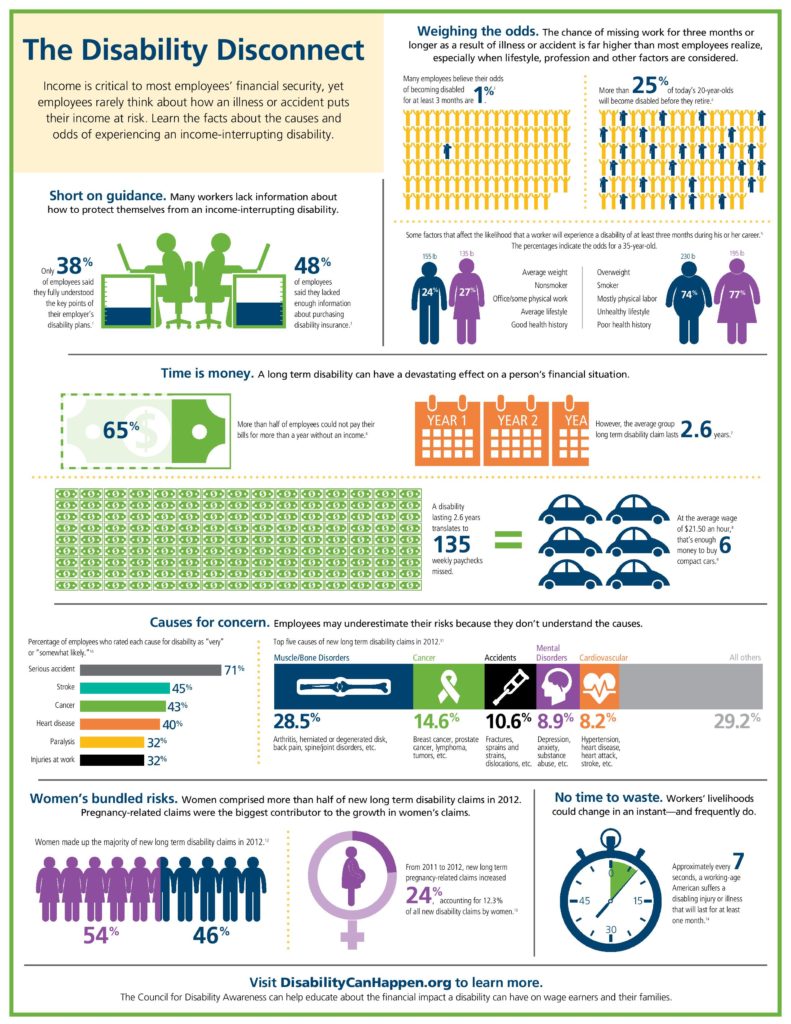

Weighing the Odds

This is the type of disability insurance statistic that compares to my earlier comments about the long term care industry. Yes, a large percentage of young people will miss an extended period of time from work due to sickness or injury during their lifetime.

I focus on catastrophic situations. Most people that we deal with are high net worth, high income, or both.

If you have 6-24 months in emergency savings, then this statistic shouldn’t scare you too much. The average disability is 31-34 months and is drastically skewed by those with lifetime disabilities and older individuals (who tend to be disabled longer).

Just make sure you have coverage and don’t worry about becoming a statistic.

Time Is Money

If you’re not making money, things are going to go south very quickly. Most financial advisors advocate having 6 months of living expenses saved for emergencies. According to a 2016 GoBankingRates survey, 69% of Americans have less than $1,000 in savings. Only 15% had more than $10,000.

This statistic could result in a catastrophic outcome for many Americans, should they face a prolonged absence from work due to sickness or injury.

The main issue is that if you have less than 10k in savings, do you have the income to purchase a disability insurance policy? Maybe…but it is doubtful.

Causes for Concern

I find this fairly accurate. Most people look at a disability as an accident or a “big health issue”, such as cancer, stroke, or heart issues.

Interestingly, the largest cause of disability is musculoskeletal. This is evident not just because of the disability insurance statistics, but because of the exclusions we consistently see applied to the policies of clients with these issues.

Cancer, heart, and accident also have their places; however, mental/nervous disorders also play a huge role in disability insurance claims. These illnesses also have a high exclusion rate (where the disability insurance carriers offer disability insurance coverage for any sickness/accident except for the excluded condition).

Women’s Bundled Risks

This one is a reality. Women typically pay 30% or more for disability insurance than men. The main reason is they go on claim more often than men.

As the infographic points out, complications from pregnancy are a major factor. You might think, “Wait, the infographic says nothing about complications, just pregnancy.”

Most disability insurance plans don’t allow for claims for pregnancy. The only allowable claim is typically a complication.

PRO TIP

A woman’s higher rate can be mitigated by using a gender-neutral policy. These can be attained through the group market or in a multi-life scenario. Some carriers will offer multi-life pricing on a gender neutral or unisex basis. If you’re a woman with your own company or you work for a company with other women who would like to save money on their disability insurance, contact us today.

No Time to Waste

Disability insurance statistics are geared to make you buy disability insurance. Most “stats” you hear are provided for this purpose.

As I tell my agents, there is no such thing as an insurance emergency. You either pay the premium or you own the loss.

If you want disability insurance, buy it. If you think you’re underinsured through work, let us do a complimentary analysis. The bottom line is this: No one should force or scare you into purchasing any type of insurance.

You either see the value or you don’t.

In Summary

The bottom line is there are A LOT of people that can benefit from having a personal or supplemental disability insurance policy. That doesn’t mean he or she should be pressed or scared into purchasing this coverage. It either makes sense or it doesn’t.

If purchasing disability insurance makes sense for you, please contact me directly at 888-636-2310 or simply fill out the contact form on the left. I look forward to hearing from you.