- Start Here

- Learn More

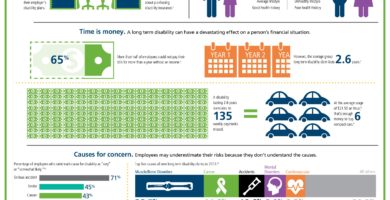

- The Top 12 Things That You Should Know About Disability Insurance

- How Much Does Disability Insurance Cost?

- Disability Insurance 101: Insurance Underwriting

- Disability Insurance 101: Disability Insurance Companies

- Disability Insurance 101: Policy Design

- Disability Insurance for Business Owners

- Your Occupation and Disability Insurance

- Your Health and Disability Insurance

- Accident Disability Insurance

- Loan Protection Insurance

- Special Risk Insurance Coverage

- Long-Term Disability Questions

- Articles

- About

- Contact